6455 W. Camero Ave

Las Vegas, NV 89139

ph: +1.415.309.5542

info

Public-Private-Partnership Insights

Overview of Public-Private-Partnerships

Public Private Partnerships (PPP or P3) is an umbrella term for many forms of private-sector involvement in the provision of traditional public-sector services. A PPP is a set of contractual arrangements between a public agency and a private-sector entity structured to meet the need of the public by:

- Optimizing the skills and resources of each party (both public and private) in delivering a service or facility for the use of the general public

- Allocating the risks in the delivery of the service and/or facility to the parties best able to manage them

PPPs can be applied to a variety of infrastructure:

- Utilities (power stations, district cooling, waste water and municipal waste)

- Social Infrastructure (hospitals, schools, worker accommodation and prisons)

- Transport (roads, bridges, airports, metros and public transport)

PPPs Take Many Different Forms

Spanning the range of private sector control and responsibility, from technical assistance and management contracts to privatizations, P3s should be designed and structured for the public need, including the influencing factors of the political and economic landscape.

Infrastructure Asset Procurement Options

There is a range of private sector participation in public infrastructure

Traditional Procurement

The procurement of assets by the public sector using conventional lowest price and government funding

Design, bid, build, finance (DBB or DBF)

Public Private Partnership

- Build, operate and transfer (BOT)

- Build, operate and own (BOO)

- Design, build, finance, operate and maintain (DBFOM)

Full Privatization

- Publicly regulated but privately owned in perpetuity

PPP Characteristics

There are many PPP structures but a typical one has the following characteristics:

- Long-term contractual arrangements

- Public sector retains strategic control over service delivery

- Private-sector contractor takes full responsibility for design, delivery and operations

- Private-sector contractor accepts the responsibilities and risks of delivering the project (constructing, start up and operating)

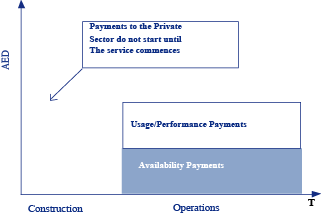

- Payments are made by the public sector partner for performance and availability and in some cases usage

- Whole life costs are minimized compared to public-sector delivery of service

- Designed to encourage the most efficient use of public-sector resources

The basic PPP structure

Risk Transfer in PPP Contracts

PPP objectives

Long-term output-based contract:

- For delivering a specified asset condition and service with appropriate incentives for performance over the life of the contract

- Capital costs paid over the lifetime of the contract, revenue not capital spending

Private-sector involvement:

- In the design, building and operating of infrastructure projects

- Deciding what is the most effective mechanism for delivering the specified outputs

Private-sector financing (both equity and debt):

- Underpins business responsibility to deliver under contracts

- Improves scrutiny of contractors' ability to deliver contracts

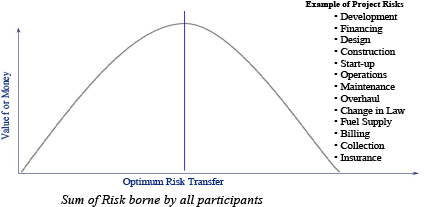

Under PPP contracts, risks are allocated through contractual structures to those parties that are best able to manage the risks. This means that only those risks are transferred to the private sector which the private sector is able to manage. Similarly, the public sector will retain those risks that it is best placed to manage. For some risks it may be appropriate for the public and private sectors to share the risk. Undertaking this risk-allocation process to arrive at an optimum risk transfer to the private sector means that VFM can be maximized.

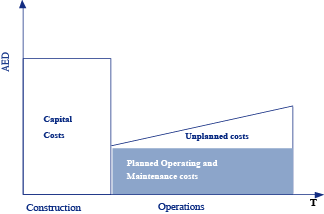

Payment profile of a typical PPP project compared to Traditional Procurement

Traditional Procurement

PPP Procurement

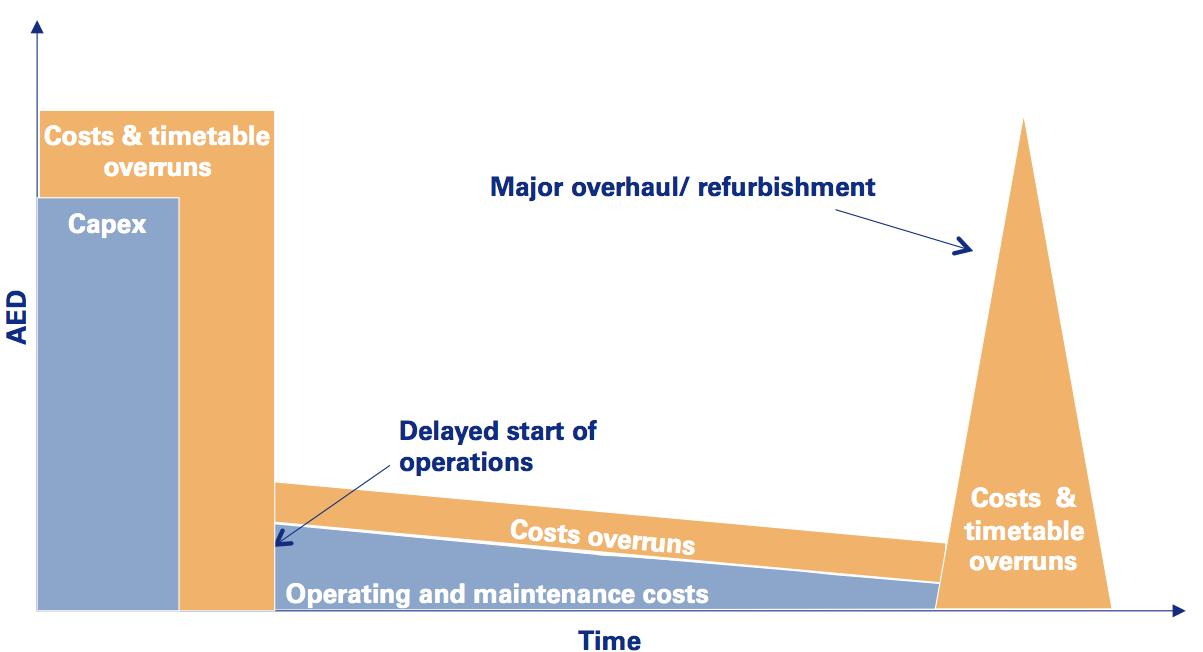

Problems with Traditional Procurement

This is what is supposed to happen…

This is what actually happens…

… and this is what the service level looks like - poor value for money

PPP Benefits

The main benefits of PPP arise from the improved management of risks transferred to the private sector. The involvement of senior lenders should ensure that all risks are identified, mitigated and managed, resulting in a comparatively mature project before contract signature:

- Provides risk transfer to the private sector and maximizes use of each parties’ strengths

- Provides additional sources of financing for public infrastructure projects

- Leverages third party revenue and development opportunities

- Focuses on outcomes and accountability through long-term contracting and partnerships

- Provides contractual incentives and disincentives to help ensure high level of service and performance

- Promotes competition and performance-based infrastructure development

- Efficiencies in Delivery:

- PPPs reduce costs and accelerate project delivery by consolidating responsibility for multiple project elements in one private entity (with conventional approaches, each element of a project is procured separately and sequentially)

- Innovation and Life-cycle Design:

- Private investors have incentives to fully capitalize a project and incorporate innovations upfront to reduce whole life costs (O&M and lifecycle costs)

- PPPs encourage the private sector to come forward with creative ideas by rewarding innovation

PPP Cost and Schedule Efficiencies

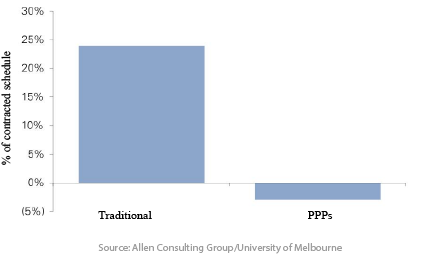

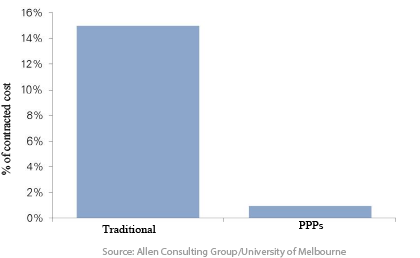

A December 2007 study of 21 PPPs and 33 traditional projects in Australia found that traditional projects experienced significant cost overruns and schedule delays while PPPs were generally delivered on time and on budget. These overruns are relative to the price and timetable agreed to at the time of contract signature.

The study revealed that on a contracted A$4.9 billion of PPP projects, net cost overrun was only A$58 million (a 1.2% overrun). For A$ 4.5 billion of traditional procurement projects, net cost overrun amounted to A$ 673 million (a 15% overrun).

The study also showed that 23.5% of traditionally-procured projects were delivered late and no PPP procured projects were delivered late. In fact, 3.4% of the PPP projects were actually delivered ahead of schedule.

In October 2009 the UK National Audit Office issued a report which supported the overall conclusions of the Australian study: PPPs are much more likely to be on time and on budget. The UK study consisted of 114 PPP projects and 400 traditionally-procured projects.

Of the 35% of the projects in the UK study that experienced cost overruns, only 14.3% of these projects had cost overruns of 5% or more. That is, nearly 95% of PPP projects were delivered “on or close to budget”.

The HM Treasury in the UK estimates that road and prison projects undertaken through PPP have delivered average savings of 17% compared to what the costs would have been had the projects been undertaken through traditional procurement.

The benefits of PPP should outweigh the lower cost of public sector capital:

Key principles of PPPs

Value for Money is achieved when the required quality of service is delivered at a cost that is cheaper than the cost of conventional public-sector delivery of the same services and at a quality level equal to or better than if provided by the public sector.

Value for Money is achieved when the required quality of service is delivered at a cost that is cheaper than the cost of conventional public-sector delivery of the same services and at a quality level equal to or better than if provided by the public sector.

A PPP contract transfers many of the risks of ownership of the project to the private sector, which puts its capital behind the successful delivery of the facilities and service.

The payment structure (or tariff mechanism) is the principal means of defining the risk allocation within the project.

Bids should be compared for:

- Value

- Contractors’ ability to accept risk

- Benefits compared to a conventional solution

- Innovation

- Suitability as a long-term supply partner

The public-sector partner should concentrate on stipulating the required service outputs, allowing the PPP Contractor as much latitude as possible as to how these output requirements are met.

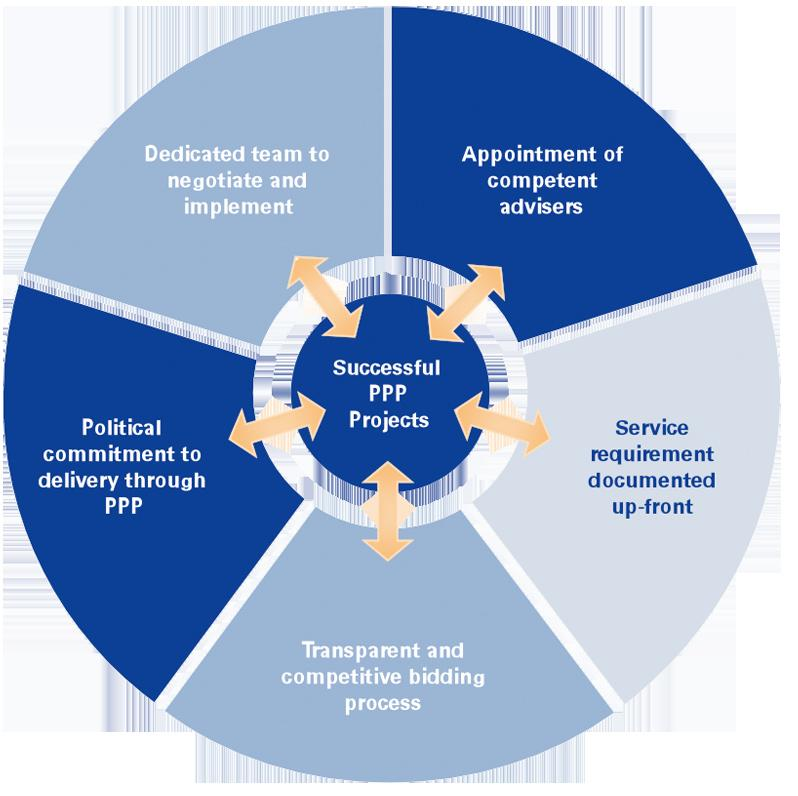

Success factors in PPP procurement

To take advantage of the potential benefits of PPP, the public sector needs to recognize the need for the above success factors to be in place.

This will help to ensure that PPP will deliver the expected Value for Money.

UK PPP Guidelines (2007)

Although long, we think this document is one of the better P3 summaries for learning because it covers the basic structures of P3 contracts in most areas and suggests approaches and debates to alternative structures. However, do not treat it as "the only" way to do things, as each project is unique.

VfM Guide - Infra Ontario (2007)

This document provides a good basic explanation of the Value for Money (VfM) analysis.

P3 Procurement Guide - British Columbia (2011)

This document provides a good summary of P3 procurement analysis, including VfM.

Copyright 2023 p3point. All rights reserved.

6455 W. Camero Ave

Las Vegas, NV 89139

ph: +1.415.309.5542

info